Is the Tao smarter than the Dow?

A high-return investment hiding in plain sight

[This article is a 4/10 on the mysticism to materialism scale].

Investor and author Eric Markowitz has a remarkable survival story. In early 2023, he received a life-threatening diagnosis. Doctors discovered a “rapidly enhancing lesion” about the size of a walnut deep in his cerebellum. The lesion could either have been terminal brain cancer, or an equally dangerous infection. Either diagnosis carried an extremely high risk of death. But he not only survived surgery, the pathology came back benign. A one-in-a-million cerebellar abscess. It was in his brain for almost six weeks and nobody knows why it didn’t rupture.

Eric’s brush with death led him to be fascinated by survival, specifically the concept of what makes for an enduring business. He’s been traveling around the world researching his book OUTLAST, which I am certain is destined for bestseller status.

I recently had the privilege of interviewing Eric at the annual general meeting for a venture capital firm. I asked him what he had discovered in all his travels so far. Whether it’s luxury cashmere or fishhooks, Eric has found a pattern among long-lived companies. Yes, they are obviously relentlessly focused on the quality of their product and customer satisfaction. But, perhaps less intuitive, is his observation that these companies tend to treat their employees like family.

He recounted one anecdote. He spent time at the 500-year-old gunmaker Beretta, and interviewed the 16th generation CEO. He also spent time with workers, one of whom was a 4th generation Beretta employee. Her family cares for the business, just as much as the business cared for them, which feels increasingly rare in modern society. All around the world, he’s heard similar stories: how companies built housing, schools, and even hospitals to care for their employees.

That loyalty to their workers may look “expensive” on paper, but the company stewards argue that this approach is essential to innovation, prosperity, and the endurance of the firms they operate.

Even though many of these founders obviously come from multi-generational wealth, one of the reasons they continue to work is that they are often treated like family by the members of their own company. This was the insight that interested me the most.

Isolation or Integration?

For the last couple of years I’ve been running a community for generally wealthy and successful people. As it’s now mostly referral, the hit rate for new members being a good fit has been about 90%. The rarer exceptions have tended to be the wealthiest and most prominent applicants. As our community is deliberately capped at 150 members, it’s not been a big problem. But it’s a serious issue for the larger communities I’ve studied that cater more to the ultra-wealthy. This dynamic fascinates me because I think it could transform the way we think about leadership and money.

We’ve seen an extremely clear pattern within Leading Edge: the more other members someone meets, the more value they receive from the community. With notable exceptions, the wealthiest members have been least likely to be super-nodes, and the most likely to be isolated.

This isn’t that surprising. Our current economic system rewards left-hemispheric dissociation, mastery of abstractions and sometimes even sociopathic detachment. So it makes sense that wealthy executives tend to be more isolated. But even into second and third generation wealth, their kids often can’t know who their friends really are, or engage in society in the healthy ways they want to. Philanthropy is obviously great, but because it’s often a one-way flow of resources, it doesn’t really impact the donor’s ability to genuinely integrate with the world; to receive.

Survive, Compete, Then Thrive

I recently flew to Los Angeles for a weekend with developmental coaches Brian and Nicole Whetten. They were hosting an Authentic Leadership Intensive to train a new generation of founders and coaches.

One of their most powerful frameworks is the “fuel source” model. They map leadership mindsets into three distinct modes. Each level receives exponentially higher power, awareness and energy.

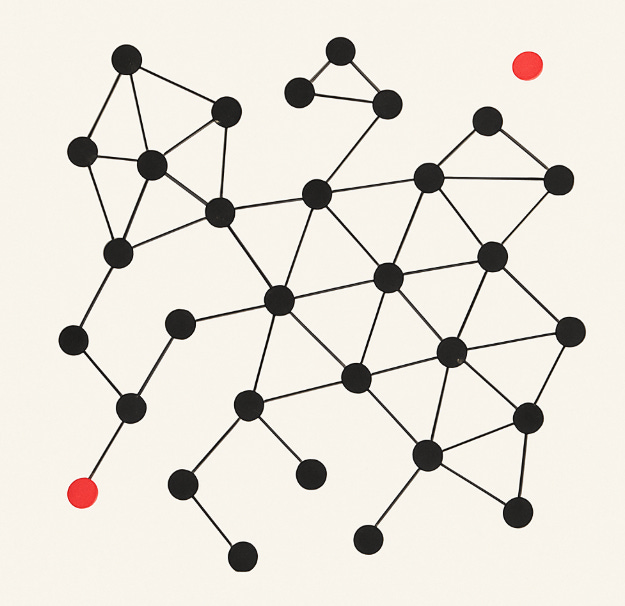

The red boxes, lose-lose, rely on the intelligence of one flawed individual. This is the doomed CEO convinced that they’re right and everyone else is wrong. The blue boxes, common to the win-lose iteration of capitalism, are much more powerful because they aggregate the intelligence of all the market’s participants: the power of the Dow.1 Authentic leadership is exponentially more powerful than both because it draws from an external intelligence and energy source: the Tao.

The Tao fuels the top four boxes (mature love, contribution, growth and creativity), and it’s what the best leaders receive from their relationships and businesses.

Many people use the word “service” to describe the ideal form of leadership. But I vastly prefer contribution. You are co-creating with emergence to bring something uniquely personal into the world that benefits everyone. In a virtuous circle, contribution fuels creativity and growth.

And, as Eric Markowitz’s research confirms, mature love is also a feature of enduring businesses. He cites the example of a a 17th generation steward who said that his life’s work is to create better lives for his employees. He says that seeing them succeed is far greater success than selling their product. This kind of leader also receives the love of their employees. Mature love doesn’t equate to weakness. As we discussed with Dr. Julia Mossbridge, her research on the science of unconditional love shows that mature love can mean making hard decisions, even moving on employees you believe will genuinely be happier in a different career. In return: this kind of leadership requires a humility and receptivity to environmental feedback that is rare at the highest levels of Western business. You can’t access the infinite intelligence of the Tao if you don’t even know it exists.

The next generation of leaders will need to be open to this force, this love, which is why authentic leadership is based on receiving.

Back to the Main Quest

I’m allergic to wafty thinkpieces on “how to redesign capitalism” that don’t land back in the world of individual agency. It has become increasingly obvious to me that pretty much all of our problems are downstream of consciousness.

As I have written before, one of the easiest ways to reintegrate dissociated capital is for wealthy people to pay for transformational work on themselves. This will allow them to increasingly access the Tao and produce positive-sum creations. I call this the Integration Economy. Today Bodhi wrote an important piece on the transformative impact of allocating a “mystical budget” for his family, specifically working with River Kenna. We all need communities, and wise advisors like Bodhi, to tell us where to safely invest time and money. Imagine the revolution if the world’s family offices diversified just 0.01% of their assets into the deliberate evolution of their individual consciousness? It’s the most neglected investment I can think of relative to the unlimited potential ROI.

Individual investors and traders who consistently believe they’re smarter than the collective human intelligence of the market often end up in deep trouble. Societies that believe the collective human intelligence of the market is smarter than the Tao seem destined to do the same. kyla scanlon’s article this week on AI, gambling and the “vibecession” is one of the best syntheses of our deteriorating economic environment that I’ve read in years. I believe our financially nihilistic youth only gamble on win-lose games because they don’t yet know there’s a win-win force more benign than luck.

More broadly, I’m curious if win-win businesses can survive and thrive in an economy that’s becoming increasingly win-lose. So a core question I wrestle with in my work is: is the Tao smarter than the Dow?

I suspect the main quest right now for any “wise-agency” leader is to find out. To learn if receiving material abundance follows the right contribution. To see if money shows up as a consequence of making the right choices and learning the right lessons. I’ve seen it happen consistently in my own life, and in many others. Witnessing these mini-miracles leads to faith, faith leads to safety, safety leads to openness and openness leads to receiving even more “love.” Once that happens we feel the urge to consume and accumulate far less, because we are held in daily loving flow by something exponentially more powerful than money.

Yes, I know it’s an outdated index, but the pun doesnt work otherwise.

Really enjoyed this

This is great Tom, but holy moly - I CAN-NOT-WAIT for Eric's book 😆